这两天发生了一件大事,崔永元通过曝出演艺圈明星“阴阳合同”问题,引发全社会关注。

在小崔发布微博之后,国家税务总局反应迅速,回应将调查核实“阴阳合同”中的涉税问题。(点这里看阴阳合同用英文怎么说以及合同的翻译要避免哪些坑)

国家税务总局官网表示,针对近日网上反映有关影视从业人员签订“阴阳合同”中的涉税问题,国家税务总局高度重视,已责成江苏等地税务机关依法开展调查核实。如发现违反税收法律法规行为,将严格依法处理。

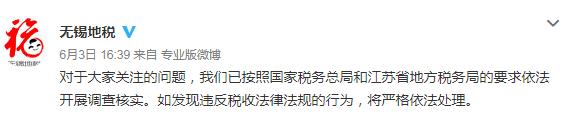

之后,@无锡地税官方微博回应,“对于大家关注的问题,已开展调查核实”。

事件还在持续发酵,今天主要来学习一下刑法中与税务相关违法行为的条文及其翻译。

Section 6. Offenses Against Tax Collection and Management

第六节 危害税收征管罪

Article 201. Tax payers found guilty of forging, altering, concealing, or indiscriminately destroying accounts books, entry proofs, or making unsubstantiated expenditures, or failing to enter or enter lower income items, or failing to submit tax returns after being notified by the tax authorities, or submitting a false return, or failing to pay taxes or pay less, or evading taxes exceeding 10 percent but less than 30 percent of payable taxes, or evading taxes again after two administrative sanctions for tax evasion, shall be punished with imprisonment or criminal detention of less than three years, with a fine of over 100 percent but less than 500 percent of the evaded tax amount; for cases with evaded tax amount exceeding 30 percent of payable taxes, or exceeding 100,000 yuan, with imprisonment of over three years but less than seven years, with a fine of over 100 percent but less than 500 percent of the evaded tax amount.

Withholding agents using the preceding means to refuse payment and full payment of withheld or collected taxes, which are over 10 percent of payable taxes or over 10,000 yuan, shall be punished in accordance with the preceding paragraph.

Multiple commissions of the acts mentioned in the two preceding paragraphs without detection shall be calculated on an accumulated basis.

第二百零一条【偷税罪】纳税人采取伪造、变造、隐匿、擅自销毁帐簿、记帐凭证,在帐簿上多列支出或者不列、少列收入,经税务机关通知申报而拒不申报或者进行虚假的纳税申报的手段,不缴或者少缴应纳税款,偷税数额占应纳税额的百分之十以上不满百分之三十并且偷税数额在一万元以上不满十万元的,或者因偷税被税务机关给予二次行政处罚又偷税的,处三年以下有期徒刑或者拘役,并处偷税数额一倍以上五倍以下罚金;偷税数额占应纳税额的百分之三十以上并且偷税数额在十万元以上的,处三年以上七年以下有期徒刑,并处偷税数额一倍以上五倍以下罚金。

扣缴义务人采取前款所列手段,不缴或者少缴已扣、已收税款,数额占应缴税额的百分之十以上并且数额在一万元以上的,依照前款的规定处罚。

对多次犯有前两款行为,未经处理的,按照累计数额计算。

Article 202. Using violence or threatening means to refuse payment of tax shall be punished with imprisonment or criminal detention of less than three years, with a fine of over 100 percent but less than 500 percent of the amount of taxes so refused to pay; for cases of a serious nature, with imprisonment of over three years but less than seven years, with a fine of over 100 percent but less than 500 percent of the amount of taxes so refused to pay.

第二百零二条【抗税罪】以暴力、威胁方法拒不缴纳税款的,处三年以下有期徒刑或者拘役,并处拒缴税款一倍以上五倍以下罚金;情节严重的,处三年以上七年以下有期徒刑,并处拒缴税款一倍以上五倍以下罚金。

Article 203. Taxpayers who fail to settle payable taxes, or transfer or conceal property resulting in tax organs being unable to recover the owed taxes of over 10,000 yuan but less than 100,000 yuan, shall be punished with imprisonment or criminal detention of less than three years, with a fine or a separately imposed fine of over 100 percent and less than 500 percent of the unsettled amount; if the amount in question exceeds 100,000 yuan, with imprisonment of over three years but less than seven years, with a fine of over 100 percent but less than 500 percent of the unsettled amount.

第二百零三条【逃避追缴欠税罪】纳税人欠缴应纳税款,采取转移或者隐匿财产的手段,致使税务机关无法追缴欠缴的税款,数额在一万元以上不满十万元的,处三年以下有期徒刑或者拘役,并处或者单处欠缴税款一倍以上五倍以下罚金;数额在十万元以上的,处三年以上七年以下有期徒刑,并处欠缴税款一倍以上五倍以下罚金。

Article 204. Using false export reports or other fraudulent means to defraud state export tax refunds involving a relatively large amount shall be punished with imprisonment or criminal detention of less than five years, with a fine of over 100 percent but less than 500 percent of the defrauded tax refund; for cases involving large amounts or of a serious nature, with imprisonment of over five years but less than 10 years, with a fine of over 100 percent but less than 500 percent of the defrauded tax refund; for cases involving extraordinarily large amounts, or of a especially serious nature with imprisonment of over 10 years or life imprisonment, with a fine of over 100 percent but less than 500 percent of the defrauded tax refund, or with forfeiture of property.

Tax payers using the fraudulent means mentioned in preceding paragraph to deceptively reclaim their paid taxes shall be convicted and punished according to provisions of Article 201, with those who deceptively claim more than what they have paid, being punished according to provisions of the preceding paragraph.

第二百零四条【骗取出口退税罪、偷税罪】以假报出口或者其他欺骗手段,骗取国家出口退税款,数额较大的,处五年以下有期徒刑或者拘役,并处骗取税款一倍以上五倍以下罚金;数额巨大或者有其他严重情节的,处五年以上十年以下有期徒刑,并处骗取税款一倍以上五倍以下罚金;数额特别巨大或者有其他特别严重情节的,处十年以上有期徒刑或者无期徒刑,并处骗取税款一倍以上五倍以下罚金或者没收财产。

纳税人缴纳税款后,采取前款规定的欺骗方法,骗取所缴纳的税款的,依照本法第二百零一条的规定定罪处罚;骗取税款超过所缴纳的税款部分,依照前款的规定处罚。

Article 205. Falsely issuing exclusive value-added tax invoices or other invoices to defraud export tax refunds or to off set taxes shall be punished with imprisonment or criminal detention of less than three years, with a fine of over 20,000 yuan and less than 200,000 yuan; for cases involving relatively large amounts of falsely reported taxes, or of a serious nature, with imprisonment of over three years and less than 10 years, with a fine of over 50,000 yuan but less than 500,000 yuan; for cases involving large amounts of falsely reported taxes, or of a more serious nature, with imprisonment of over 10 years or life imprisonment, with a fine of over 50,000 yuan but less than 500,000 yuan, or with forfeiture of property.

Committing acts mentioned in the preceding paragraph to defraud state taxes shall, if the amount involved is extraordinarily large, and of a especially serious nature that causes particularly heavy losses to the state, be punished with life imprisonment or death, and with forfeiture of property.

Units committing offenses under this article shall be punished with a fine, with personnel directly in charge or other directly responsible personnel being punished with imprisonment of criminal detention of less than three years; for cases involving relatively large amounts of taxes, or with a serious nature, with imprisonment of over three years but less than ten years; for cases involving large amounts of taxes, or of a especially serious nature, with imprisonment of over 10 years or life imprisonment.

Falsely issuing exclusive value-added tax invoices or other invoices to defraud export tax refunds or to off set taxes refers to any false issuance intended for others or himself, or letting others falsely issue for him, or induce others to falsely issue.

第二百零五条【虚开增值税专用发票、用于骗取出口退税、抵扣税款发票罪】虚开增值税专用发票或者虚开用于骗取出口退税、抵扣税款的其他发票的,处三年以下有期徒刑或者拘役,并处二万元以上二十万元以下罚金;虚开的税款数额较大或者有其他严重情节的,处三年以上十年以下有期徒刑,并处五万元以上五十万元以下罚金;虚开的税款数额巨大或者有其他特别严重情节的,处十年以上有期徒刑或者无期徒刑,并处五万元以上五十万元以下罚金或者没收财产。

有前款行为骗取国家税款,数额特别巨大,情节特别严重,给国家利益造成特别重大损失的,处无期徒刑或者死刑,并处没收财产。

单位犯本条规定之罪的,对单位判处罚金,并对其直接负责的主管人员和其他直接责任人员,处三年以下有期徒刑或者拘役;虚开的税款数额较大或者有其他严重情节的,处三年以上十年以下有期徒刑;虚开的税款数额巨大或者有其他特别严重情节的,处十年以上有期徒刑或者无期徒刑。

虚开增值税专用发票或者虚开用于骗取出口退税、抵扣税款的其他发票,是指有为他人虚开、为自己虚开、让他人为自己虚开、介绍他人虚开行为之一的。

Article 206. Forging or selling forged exclusive value- added tax invoices shall be punished with imprisonment or criminal detention of or restriction for less than three years, with a fine of over 20,000 yuan but less than 200,000 yuan; for cases involving relatively large quantities, or of a serious nature, with imprisonment of over three years and less than 10 years, with a fine of over 50,000 yuan but less than 500,000 yuan; for cases involving large quantities or of a especially serious nature, with imprisonment of over ten years or life imprisonment, with a fine of over 50,000 yuan but less than 500,000 yuan, or with forfeiture of property.

Committing forgery and the sale of forged exclusive value-added invoices in extraordinarily large quantities or of a especially serious nature that severely disrupt economic order shall be punished with life imprisonment or death, with forfeiture of property.

Units committing offenses under this article shall be punished with a fine, with personnel directly in charge or other directly responsible personnel being punished with imprisonment or criminal detention, or restriction for less than three years; for cases involving relatively large quantities or of a serious nature, with imprisonment of over three years but less than 10 years; for cases involving large quantities or of a especially serious nature, with imprisonment of over 10 years or life imprisonment.

第二百零六条【伪造、出售伪造的增值税专用发票罪】伪造或者出售伪造的增值税专用发票的,处三年以下有期徒刑、拘役或者管制,并处二万元以上二十万元以下罚金;数量较大或者有其他严重情节的,处三年以上十年以下有期徒刑,并处五万元以上五十万元以下罚金;数量巨大或者有其他特别严重情节的,处十年以上有期徒刑或者无期徒刑,并处五万元以上五十万元以下罚金或者没收财产。

伪造并出售伪造的增值税专用发票,数量特别巨大,情节特别严重,严重破坏经济秩序的,处无期徒刑或者死刑,并处没收财产。

单位犯本条规定之罪的,对单位判处罚金,并对其直接负责的主管人员和其他直接责任人员,处三年以下有期徒刑、拘役或者管制;数量较大或者有其他严重情节的,处三年以上十年以下有期徒刑;数量巨大或者有其他特别严重情节的,处十年以上有期徒刑或者无期徒刑。

Article 207. Committing illegal sale of exclusive value-added tax invoices shall be punished with imprisonment or criminal detention, or restriction for less than three years, with a fine over 20,000 yuan but less than 200,000 yuan.; for cases involving relatively large quantities, with imprisonment over three years but less than 10 years, with a fine of over 50,000 yuan but less than 500,000 yuan; for cases involving large quantity with imprisonment of over 10 years or life imprisonment, with a fine of over 50,000 yuan but less than 500,000 yuan, or with forfeiture of property.

第二百零七条【非法出售增值税专用发票罪】非法出售增值税专用发票的,处三年以下有期徒刑、拘役或者管制,并处二万元以上二十万元以下罚金;数量较大的,处三年以上十年以下有期徒刑,并处五万元以上五十万元以下罚金;数量巨大的,处十年以上有期徒刑或者无期徒刑,并处五万元以上五十万元以下罚金或者没收财产。

Article 208. Illegal purchase of exclusive value-added tax invoices or forged exclusive value-added tax invoices shall be punished with imprisonment or criminal detention of less than five years, with a fine or a separately imposed fine of over 20,000 yuan and less than 200,000 yuan.

Falsely issuing or reselling illegally purchased exclusive value-added tax invoices or forged exclusive value-added tax invoices shall be convicted and punished respectively under Articles 205, 206, and 207 of this law.

第二百零八条【非法购买增值税专用发票、购买伪造的增值税专用发票罪;虚开增值税专用发票罪、出售伪造的增值税专用发票罪、非法出售增值税专用发票罪】非法购买增值税专用发票或者购买伪造的增值税专用发票的,处五年以下有期徒刑或者拘役,并处或者单处二万元以上二十万元以下罚金。

非法购买增值税专用发票或者购买伪造的增值税专用发票又虚开或者出售的,分别依照本法第二百零五条、第二百零六条、第二百零七条的规定定罪处罚。

Article 209. Forging or manufacturing without authority or selling or manufacturing without authority other invoices usable for defrauding export tax refunds or offsetting taxes shall be punished with imprisonment or criminal detention and restriction for less than three years, with a fine of over 20,000 yuan but less than 200,000 yuan; for cases involving large quantities, with imprisonment of over three years but less than seven years, with a fine of over 50,000 yuan but less than 500,000 yuan; for cases involving extraordinarily large quantities, with imprisonment of over seven years, with a fine of over 50,000 yuan but less than 500,000 yuan, or with forfeiture of property.

Forging or manufacturing without authority or selling other invoices manufactured without authority, which have not been mentioned in the preceding paragraph, shall be punished with imprisonment or criminal detention of, or restriction for less than two years, with a fine of over 10,000 yuan but less than 50,000 yuan; for cases of a serious nature, with imprisonment of over two years and less than seven years, with a fine of over 50,000 yuan and less than 500,000 yuan.

Illegal sale of other invoices usable for defrauding export tax refunds or offsetting taxes shall be punished according to the first paragraph. Illegal sale of other invoices not mentioned in the third paragraph shall be punished according to the second paragraph.

第二百零九条【非法制造、出售非法制造的用于骗取出口退税、抵扣税款发票罪;非法制造、出售非法制造的发票罪;非法出售用于骗取出口退税、抵扣税款发票罪;非法出售发票罪】伪造、擅自制造或者出售伪造、擅自制造的可以用于骗取出口退税、抵扣税款的其他发票的,处三年以下有期徒刑、拘役或者管制,并处二万元以上二十万元以下罚金;数量巨大的,处三年以上七年以下有期徒刑,并处五万元以上五十万元以下罚金;数量特别巨大的,处七年以上有期徒刑,并处五万元以上五十万元以下罚金或者没收财产。

伪造、擅自制造或者出售伪造、擅自制造的前款规定以外的其他发票的,处二年以下有期徒刑、拘役或者管制,并处或者单处一万元以上五万元以下罚金;情节严重的,处二年以上七年以下有期徒刑,并处五万元以上五十万元以下罚金。

非法出售可以用于骗取出口退税、抵扣税款的其他发票的,依照第一款的规定处罚。

非法出售第三款规定以外的其他发票的,依照第二款的规定处罚。

Article 210. Theft of exclusive value-added tax invoices or other invoices usable in defrauding export tax refunds or offsetting taxes, shall be convicted and punished according to Article 264 of this law. Obtaining by fraudulent means exclusive value-added tax invoices or other invoices usable in defrauding export tax refunds or offsetting taxes shall be convicted and punished according to Article 266 of this law.

第二百一十条【盗窃罪、诈骗罪】盗窃增值税专用发票或者可以用于骗取出口退税、抵扣税款的其他发票的,依照本法第二百六十四条的规定定罪处罚。

使用欺骗手段骗取增值税专用发票或者可以用于骗取出口退税、抵扣税款的其他发票的,依照本法第二百六十六条的规定定罪处罚。

Article 211. Units committing offenses under Articles 201, 203, 204, 207, 208, and 209 of this section shall be punished with fines, with personnel directly in charge and other directly responsible personnel being punished according to these articles, respectively.

第二百一十一条【单位犯危害税收征管罪的处罚规定】单位犯本节第二百零一条、第二百零三条、第二百零四条、第二百零七条、第二百零八条、第二百零九条规定之罪的,对单位判处罚金,并对其直接负责的主管人员和其他直接责任人员,依照各该条的规定处罚。

Article 212. Fines and forfeitures of property imposed against offenders convicted under Articles 201 through 205 of this section should not be enforced until the tax authorities have recovered the taxes in question and the export tax refunds so defrauded.

第二百一十二条【税务机关征缴优先原则】犯本节第二百零一条至第二百零五条规定之罪,被判处罚金、没收财产的,在执行前,应当先由税务机关追缴税款和所骗取的出口退税款。

(译匠)